Apple will not be affected by the Trump administration’s newly announced 100% tariffs on Chinese semiconductors, due to its planned $100 billion investment in U.S.-based manufacturing and supply chain infrastructure. The exemption was reported alongside new details of Apple’s coordination with officials in Washington, highlighting how its large-scale commitment to American industry has provided a buffer against rising trade penalties targeting Chinese tech.

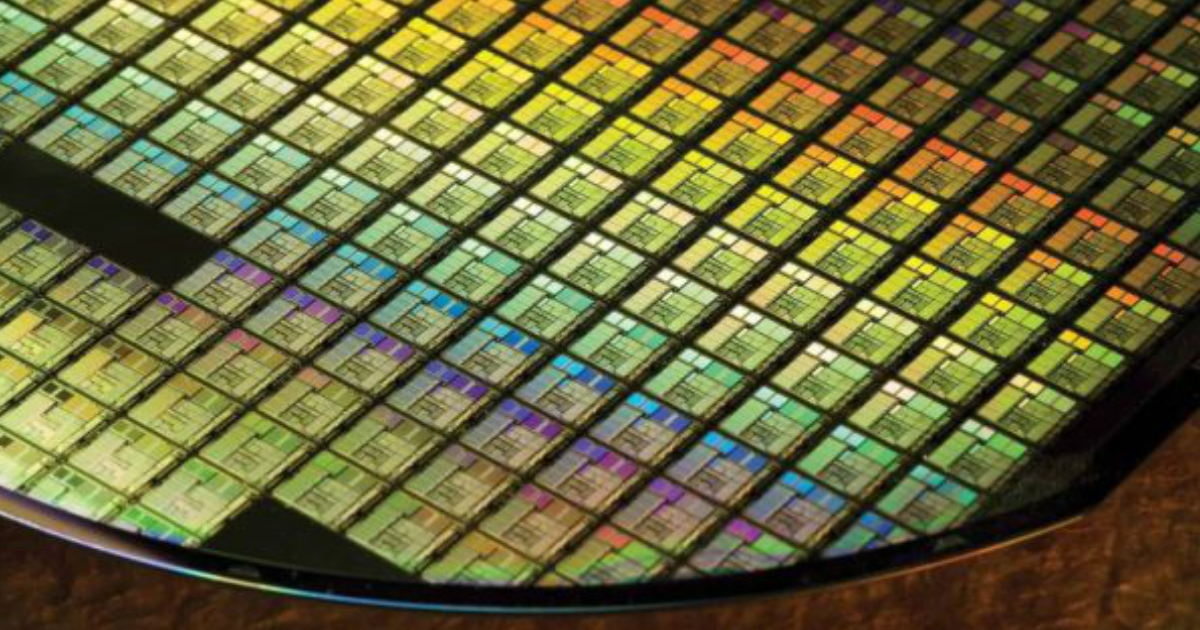

The tariffs are part of a broader effort by the Trump administration to reduce U.S. dependence on Chinese semiconductor supply chains. While many companies importing components from China will be impacted, Apple’s strategy to localize chip production has helped it avoid these costs. A key part of that strategy is its partnership with TSMC, which has begun limited 4nm chip production at its Fab 21 facility in Phoenix, Arizona. Additional phases of the plant are under construction, but 3nm and beyond are still years away.

Sources familiar with the matter indicate that Apple’s exemption is not a special exception, but rather a direct result of policy that rewards U.S.-focused investment. The $100 billion commitment spans chip production, data centers, logistics hubs, and renewable energy infrastructure. It also reflects Apple’s broader alignment with industrial goals to secure long-term technological independence from Chinese suppliers.

Avoiding the tariffs offers a major strategic advantage. Apple’s upcoming iPhone and Mac product launches will not be exposed to cost increases or delays caused by supply chain disruptions. Competitors relying on Chinese chip imports may face difficult decisions about pricing or logistics, but Apple is well-positioned to stay on schedule and on budget.

More broadly, this development shows how Apple is navigating shifting U.S. trade policy by leaning into domestic production. Its expanded relationship with TSMC in Arizona and continued investment across the country positions it as a model for multinational tech firms trying to adapt to new geopolitical and regulatory realities. The exemption also reinforces the message that significant onshore investment is now essential for companies hoping to insulate themselves from trade policy risk.