Goldman Sachs, Apple Card partner bank, has issued an investor’s note in which it explains that any Apple Car ambitions are most probably focused on the in-car experience.

Apple’s desire to develop and sell vehicles has caused its shares to rise up by 6% since Reuters published the news this Monday.

Goldman Sachs believes Apple will follow the same path as it took for the television industry

The investment note seen by Business Insider starts by making the argument that the automotive industry is historically a low-margin one, and Apple’s potential profit in the automotive industry would be minimal. One of the optimistic scenarios would be that Apple captures 5% of the electric vehicle market by 2025, and starts selling 417,000 vehicles at an average price of $75,000.

The main reason Apple and other tech companies want to be in this business is due to the large amount of time future consumers are likely to spend in self driving vehicles using information services as they make their way from point A to point B

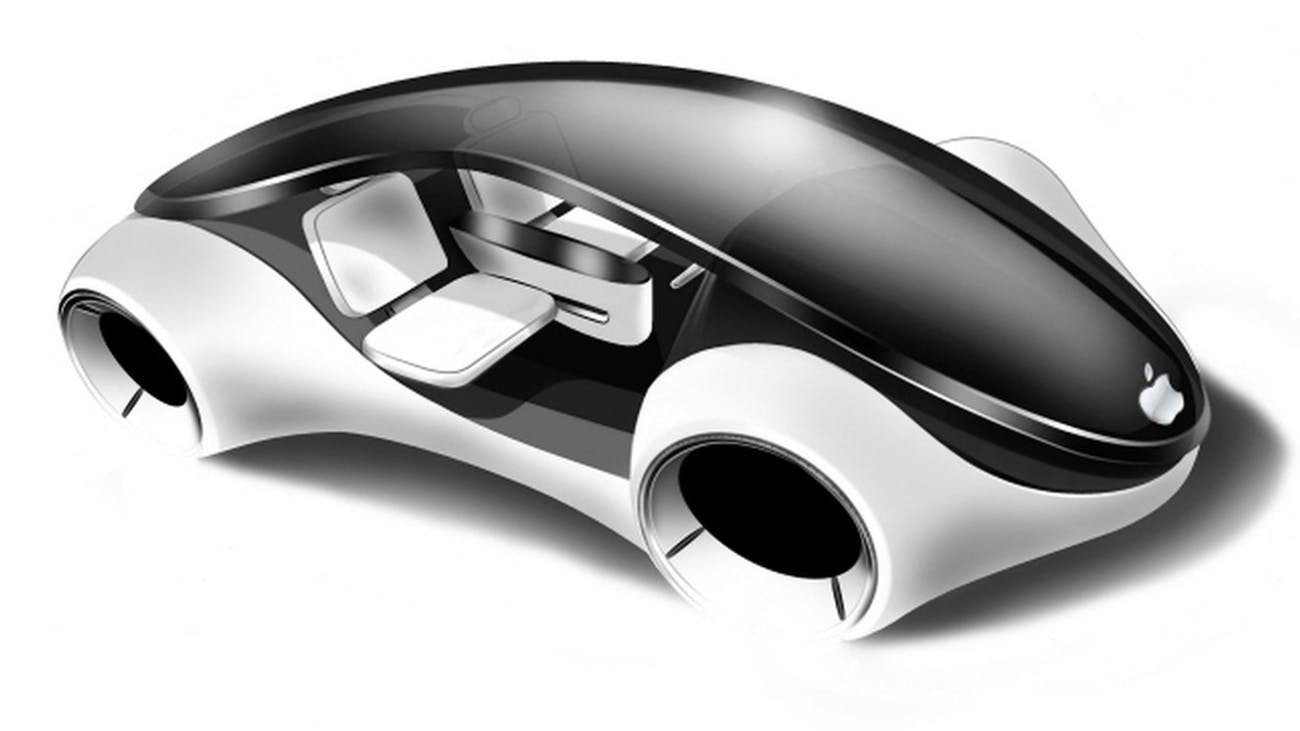

The bank makes a further argument that a car does not make sense as a product for Apple but as a platform.

“We believe that a car makes sense for Apple as a hardware platform supporting its services but the lower profitability of the auto business likely means that investors would see limited earnings impact from such a move,” Goldman explained.

Instead, Goldman ultimately sees Apple following a similar path it took in the TV industry and becoming a service provider in the electric vehicle market rather than manufacturing a low-margin vehicle from scratch, according to the note.

“[Apple] may have alternative means to provide almost as good a [car] experience without the need to develop and sell a full EV platform,” Goldman Sachs said.

Goldman Sachs believes that Apple will follow the same path it took in the television industry. Not all banks agree on this. Morgan Stanley believes that an Apple Car would provide formidable competition to Tesla, more than any other traditional automaker.

No matter which path Apple decides to take to enter the auto market, the long-term effect on its services business could be great if self-driving vehicles become the norm and drivers are able to divert their attention from the car to focus on information services.

Whether Apple manufactures a car or not, Goldman Sachs maintains its sell recommendation and its $75 price target, which represents a potential drop of 43% compared to Tuesday’s close.

Read More: