According to a story from January, Goldman Sachs suffered losses of over $1 billion as a result of its collaboration with Apple on the Apple Card. Despite this, the business insists that it is still dedicated to its partnership with the Cupertino tech giant and anticipates that it will be successful in the long term.

Goldman Sachs not interested in bidding for new credit card programs

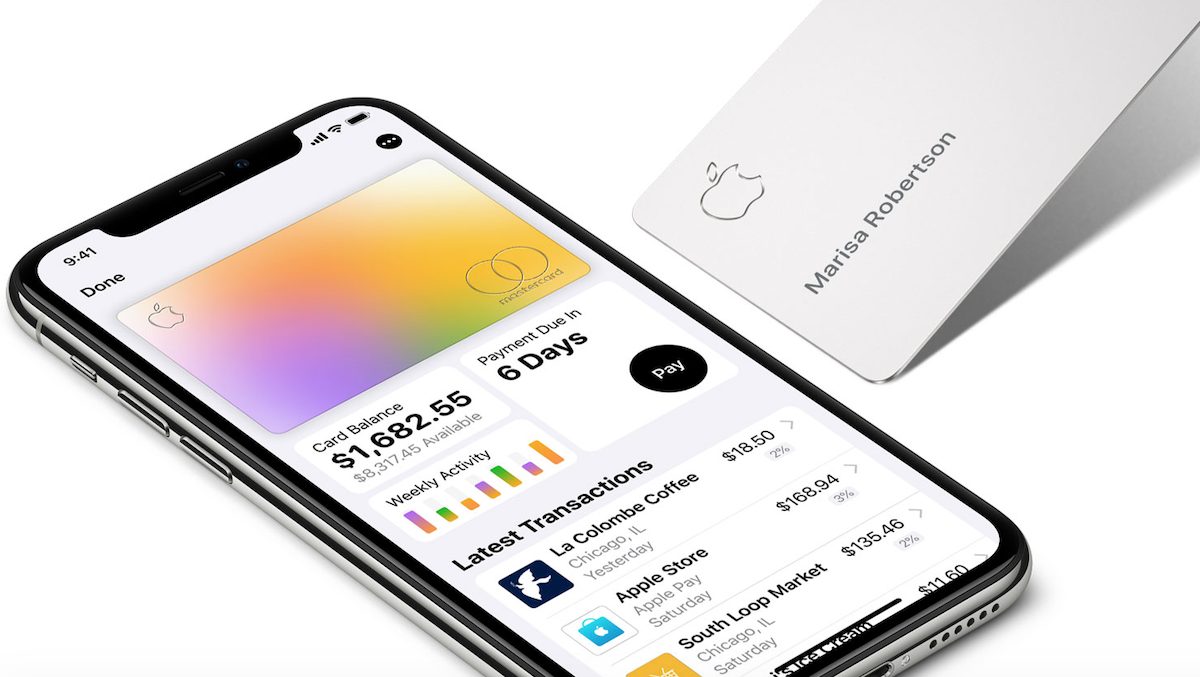

Goldman Sachs is stopping plans to further extend its credit card program, according to The Wall Street Journal. One of Goldman’s earliest ventures into consumer banking was the Apple Card. A co-branded card with General Motors is the only other consumer credit card offered by the bank. The bank had been negotiating with T-Mobile to introduce a co-branded credit card, but those talks have recently come to an end.

Along these lines, Goldman is also recalling Marcus, its larger consumer banking division. Personal loan originations are included in this category.

Despite a significant reduction in consumer banking, Goldman is still allegedly devoted to its relationship with Apple. According to a source familiar with the situation, the bank is still committed to the GM and Apple credit-card programs, the Wall Street Journal report states.

Moreover, Goldman Sachs CEO David Solomon stated this week at a conference that the bank anticipates significant dividends for the firm over time. Goldman revealed in October that it was extending its affiliation with Apple through 2029. But this collaboration goes beyond Apple Card.

As part of its efforts to lessen reliance on outside parties like Goldman Sachs, Apple is also stepping up its internal personal finance initiatives. This is known as “Project Breakout” internally, and it would internalize processes like lending, fraud analysis, and credit checks.

In contrast to Apple Card, the planned Apple Pay Later service will make greater use of Apple’s own financial resources. However, Goldman is still a partner and will technically be the authority to issue the loans. Also, Apple and Goldman Sachs are collaborating on the future Apple Card Savings account.

Read more: