Apple entered the credit card market in 2019 with the Apple Card. Marketed as a seamless blend of technology and finance, the Apple Card offers a unique set of features and benefits. But the question remains: Is the Apple Card worth it? In this article, we’ll delve into the pros and cons to help you make an informed decision about whether to add this card to your wallet.

Apple Card in review – A closer look at the benefits and drawbacks of Apple’s credit card

The pros

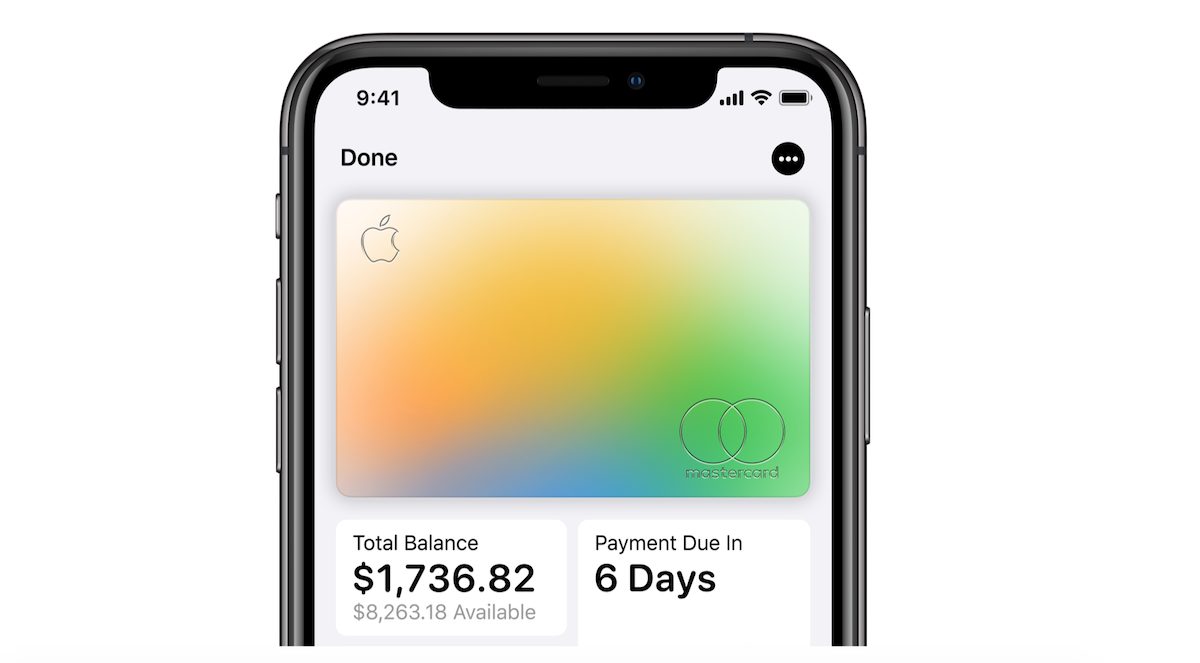

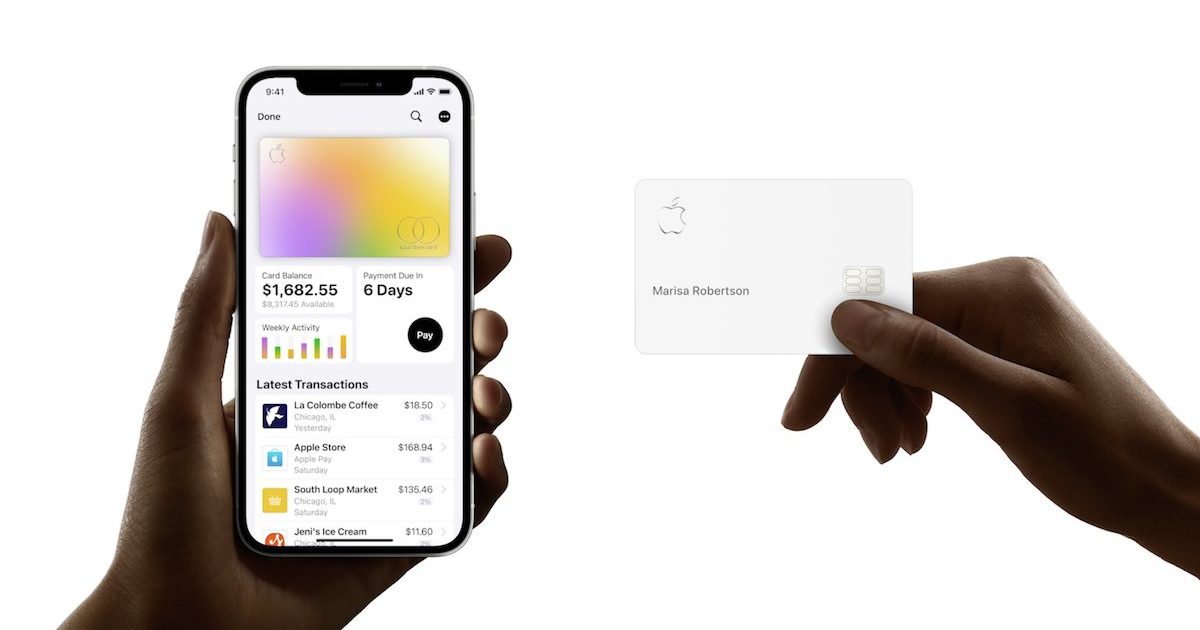

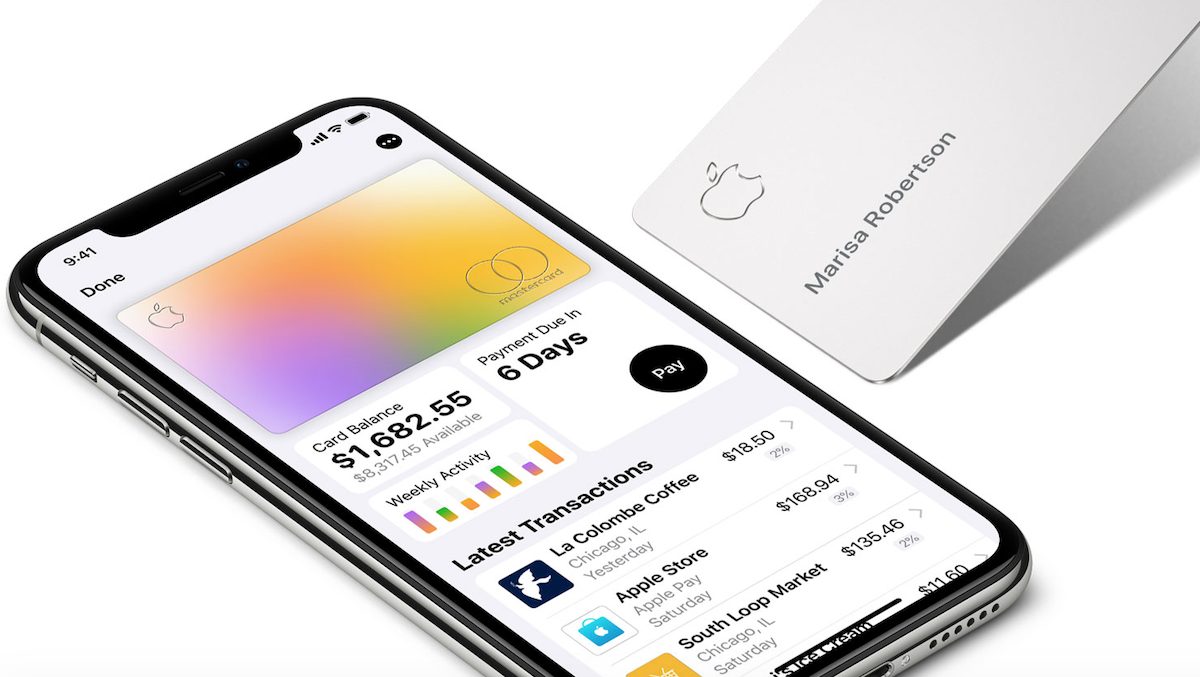

Seamless integration with Apple ecosystem: One of the standout features of the Apple Card is its tight integration with the Apple ecosystem. The card is managed through the Wallet app on your iPhone, offering real-time transaction notifications, expense tracking, and detailed spending categorization. This level of integration can make managing your finances more intuitive, especially if you’re already immersed in the Apple ecosystem.

Daily cashback: The Apple Card offers a cashback program that rewards you for your spending. You get 2% cashback on purchases made with Apple Pay and 1% cashback on physical card purchases. This cashback is credited daily, which can be a nice way to accumulate savings over time.

No fees: The Apple Card boasts no annual fees, international transaction fees, or late payment fees. This transparent fee structure can save you money and simplify your financial planning.

Privacy and security: Apple places a strong emphasis on user privacy and security. The card doesn’t have a physical card number, CVV, or expiration date printed on it. Additionally, each transaction is authorized using Face ID, Touch ID, or a unique dynamic security code, enhancing security measures and reducing the risk of fraud.

Financial health insights: The Wallet app provides a clear breakdown of your spending habits, helping you understand where your money is going. This feature can be particularly helpful for budgeting and financial planning.

The cons

Limited rewards structure: While the daily cashback is convenient, some other credit cards offer higher rewards rates on specific categories, such as dining, travel, or groceries. If maximizing rewards is a top priority, you might find better options elsewhere.

Interest rates: The Apple Card’s interest rates can be relatively high compared to other credit cards, particularly if you carry a balance from month to month. If you tend to carry a balance, the interest charges might offset the cashback benefits.

Exclusivity: The Apple Card is only available to iPhone users. This exclusivity might alienate Android users or those who don’t own Apple devices.

Limited credit-building features: While the Apple Card can help you build credit, there are other credit cards specifically designed for people looking to establish or rebuild their credit history. If this is your main goal, there might be better options available.

Limited international acceptance: While Apple Pay is gaining traction, it’s not universally accepted around the world. If you frequently travel internationally, you might encounter situations where you can’t use your Apple Card through Apple Pay.

Conclusion

Ultimately, the decision of whether the Apple Card is worth it depends on your individual financial habits, preferences, and priorities. If you’re deeply embedded in the Apple ecosystem, value seamless integration, and appreciate the security features, the Apple Card might be a solid choice. However, if you’re looking for higher reward rates or have specific credit-building needs, you might want to explore other credit card options.