Today, the market opened with an all-time high AAPL stock price of $138.05, breaking its won September 2 record of $137.59. Although the share price slightly saw some downward decline to $134.70 in intraday trading, compared to its March opening, the new 150% increase is an achievement for the company.

Apple’s upward growth was slow at the beginning of 2020 and in March the AAPL stock price was at $57.02. However, the company’s resilience in the COVID-19 pandemic to launch new products and services, despite the odds, has been fruitful. Since the COVID-19 outbreak, Apple launched new several new products in 2020: iPad Pro, iPad, iPad Air, Apple Watch Series 6, Apple Watch SE, iPhone SE, iPhone 12 line-up, M1 MacBook Air, M1 MacBook Pro, HomePod mini, Apple Fitness+, and AirPods Max.

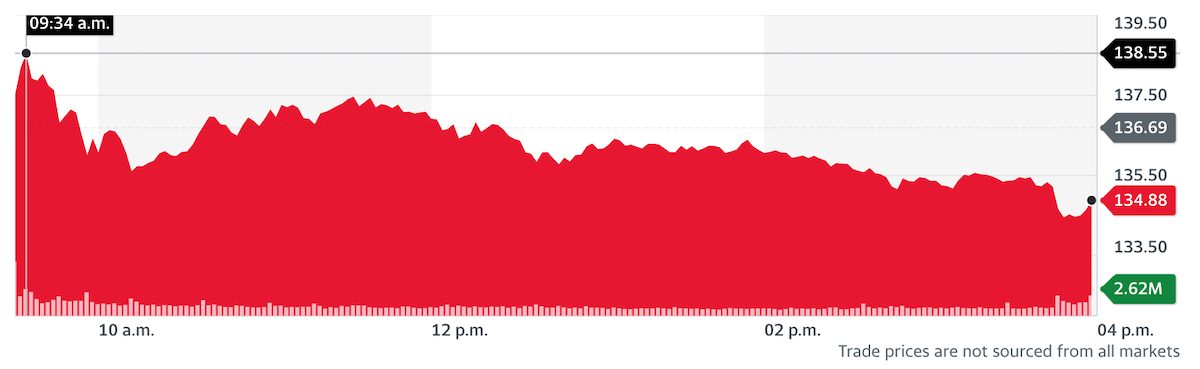

AAPL stock at an all-time high of $138.05

After the September jump, AAPL stock has experienced an impressive jump at the end of December as per Yahoo Finance. The increase can be attributed to the popularity of Apple iPhones in the Holiday session. Recently Flurry Analytics reported that iPhone took the first spot in the top 10 rankings for new device activation during 2020 Christmas with 9 out 10 smartphones activated were iPhones.

The graph shared by Flurry Analytics shows how activations jumped on Christmas Day, compared to the previous 7 day average for these same smartphones. iPhone 11 and iPhone XR, which have been the most popular and best-selling smartphones over the past few years, continued their reign, while iPhone 12 Pro Max, iPhone 12, and iPhone 12 Pro ranked 3, 4, and 7, respectively.

Furthermore, news of an alleged passenger Apple Car has also given the APPL stock price a boost. Expected to launch in 2024, Apple Car increased the company’s value by over $100 billion in the market with a $132 jump in December from $119.06 in November. With a new battery and LiDAR sensor, Reuters report that Apple will deliver a “safer” autonomous automobile. The news of the upcoming Apple Car has is welcomed by analysts at Morgan Stanley and Volkswagen.

“Analysts at Morgan Stanley are saying that tech giants like Apple can provide ‘far more formidable competition than the established OEMs’ to Tesla.”

“Chief Executive Officer at Volkswagen, Herbert Diess said that the German automaker embraces competition and anticipates innovations from newcomers in the industry.

Diess also said that rich technology giants like Apple will pose a much bigger threat for the German manufacturer than traditional rivals like Toyota Motor Corp, if the company decides to enter the auto industry.”

2 comments