In a dedicated Twitter thread, founder author of Above Avalon, Neil Cybart explained that Peloton is struggling because of Apple Fitness+. The company selling very expensive $1500 and above treadmills and exercise bikes with workout subscription service is facing a financial crisis because consumers have a more affordable alternative, Apple Fitness+.

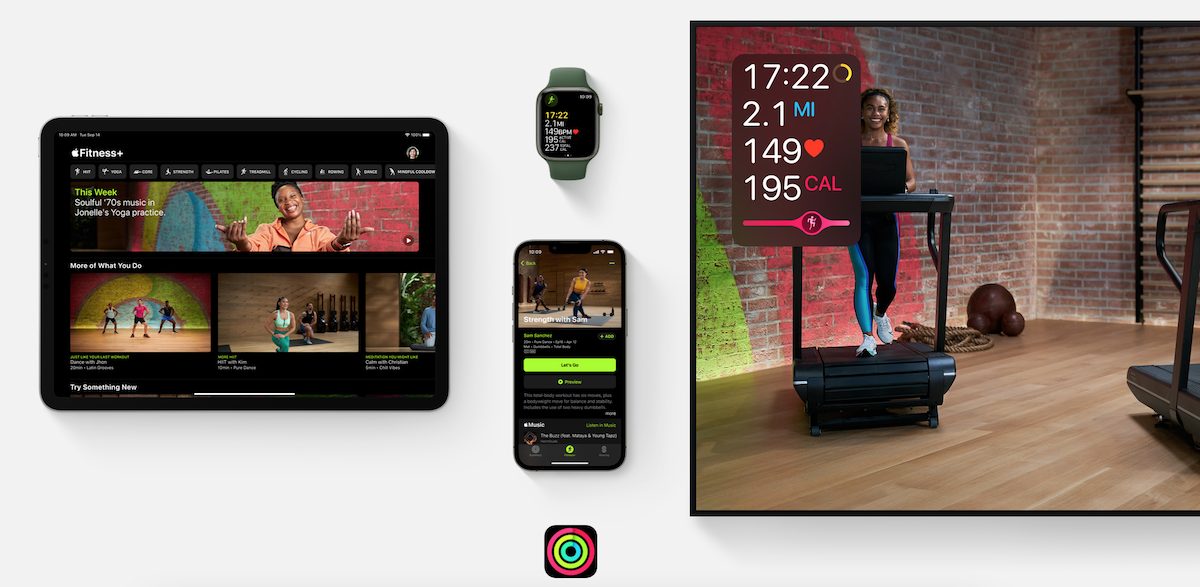

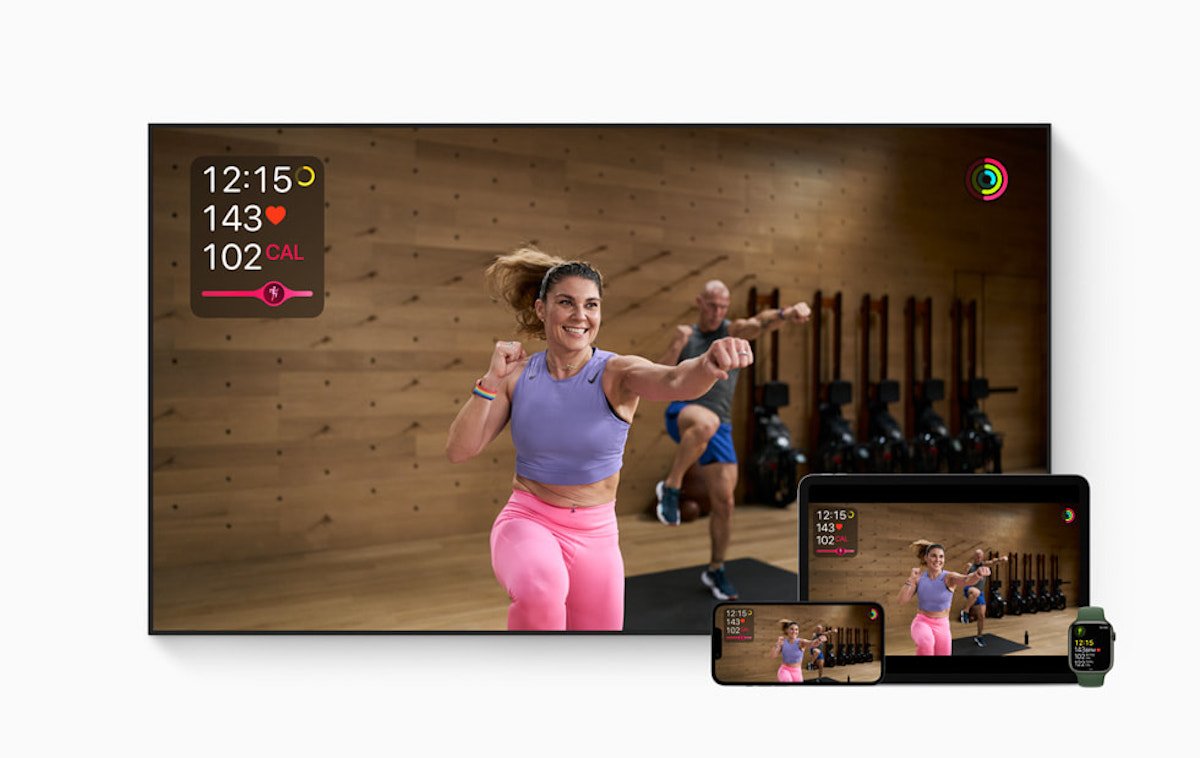

Launched in 2020, Fitness+ is a diverse at-home workout service that offers 10 to 40 minutes sessions of most types of workouts created by professionals like Yoga, HIIT, cardio, rowing, cycling, and much more. Designed around the Apple Watch, the service is available across devices so that users can view their fitness metrics on any screen.

Apple Watch users can get the Fitness+ for $9.99 per month or $79.99 per year and it can also be bought with Apple One bundles. In addition to a lower price, Apple Fitness+ removes the need to buy equipment worth thousands of dollars and these factors are impacting Peloton’s whole business model.

Peloton is in a precarious state. The # of average workouts is down, guidance remains atrocious, and the company slashed bike pricing to generate demand. Nothing seems to be working. Interest in Peloton is declining.

Apple Fitness+ has given consumers an affordable alternative to Peloton’s expensive exercise equipment and fitness classes

Cybart elaborates that Peloton’s exclusive digital fitness classes were its main product because it wanted to become a health platform, the luxury workout equipment was for a niche, to begin with.

Peloton is unable to compete with Apple on price. Apple Fitness+ is basically free when thinking of the Apple One bundle. That makes Peloton’s $13/month digital classes a hard sell. Peloton won’t be able to compete with Apple’s wearables strategy either.

Despite lower prices, the company is unable to increase demand. And he predicts that Peloton might not be able to survive the competition.

This leaves Peloton in a difficult spot. The 2021 holiday season was crucial for the company. Recent Google Trends data doesn’t match with a company generating higher buzz to grab additional users. (The spike in search traffic in 2019 was due to a controversial Peloton ad.)

Without a major change in trends in 2022, Peloton is on track to be a Fitbit 2.0 – a company unable to compete with the giants subsidizing health and fitness tracking as an ecosystem feature.

Read More: